U.S. Regulators Want More Control Oversight Into Apple Pay

The United States Consumer Financial Protection Bureau (CFPB) today proposed new oversight requirements for technology companies like Apple that offer digital wallets and payment apps.

According to the CFPB, payment services like Apple Pay are growing in popularity, but the companies behind them are not subject to the same "supervisory examinations" that banks undergo.

The newly proposed rule would require companies that handle more than five million transactions per year to adhere to the same rules as large banks, credit unions, and other financial institutions that are supervised by the CFPB.

The CFPB claims that there have been an increasing number of complaints about tech companies in the consumer finance market, and it argues that examiners should be able to carefully scrutinize the activities of tech companies to ensure they are following the law.

Big Tech and other companies operating in consumer finance markets blur the traditional lines that have separated banking and payments from commercial activities. The CFPB has found that this blurring can put consumers at risk, especially when the same traditional banking safeguards, like deposit insurance, may not apply.

Despite their impact on consumer finance, Big Tech and other nonbank companies operating in the payments sphere do not receive the same regulatory scrutiny and oversight as banks and credit unions. While the CFPB has enforcement authority over these companies, the CFPB has not previously had, inside many of these firms, examiners carefully scrutinizing their activities to ensure they are following the law and monitoring their executives.

The CFPB wants to be able to conduct examinations of tech companies to make sure that they are following funds transfer, privacy, and consumer protection laws, and adhering to the same rules that banks must follow. If finalized, the proposed rule would give the Consumer Finance Protection Bureau more oversight into the financial services provided by companies like Apple and Google.

Popular Stories

iOS 26 was released last month, but the software train never stops, and iOS 26.1 beta testing is already underway. So far, iOS 26.1 makes both Apple Intelligence and Live Translation on compatible AirPods available in additional languages, and it includes some other minor changes across the Apple Music, Calendar, Photos, Clock, and Safari apps.

More features and changes will follow in future ...

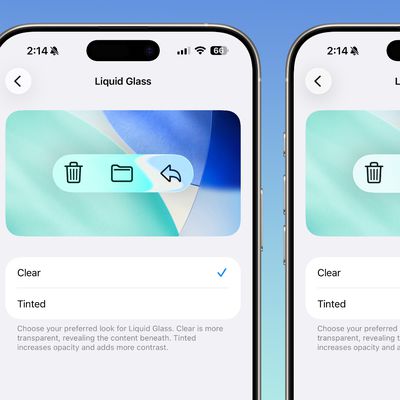

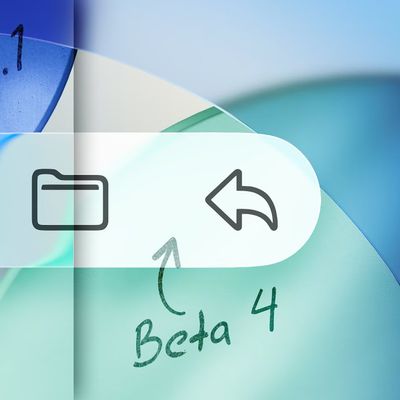

With the fourth betas of iOS 26.1, iPadOS 26.1, and macOS 26.1, Apple has introduced a new setting that's designed to allow users to customize the look of Liquid Glass.

The toggle lets users select from a clear look for Liquid Glass, or a tinted look. Clear is the current Liquid Glass design, which is more transparent and shows the background underneath buttons, bars, and menus, while tinted ...

Apple plans to cut production of the iPhone Air amid underwhelming sales performance, Japan's Mizuho Securities believes (via The Elec).

The Japanese investment banking and securities firm claims that the iPhone 17 Pro and iPhone 17 Pro Max are seeing higher sales than their predecessors during the same period last year, while the standard iPhone 17 is a major success, performing...

Apple's software engineers continue to internally test iOS 26.0.2, according to MacRumors logs, which have been a reliable indicator of upcoming iOS versions.

iOS 26.0.2 will be a minor update that addresses bugs and/or security vulnerabilities, but we do not know any specific details yet.

The update will likely be released by the end of next week.

Last month, Apple released iOS 26.0.1,...

While the new iPad Pro's headline feature is the M5 chip, the device has some other changes, including N1 and C1X chips, faster storage speeds, and more.

With the M5 chip, the new iPad Pro has up to a 20% faster CPU and up to a 40% faster GPU compared to the previous model with the M4 chip, according to Geekbench 6 results. Keep in mind that 256GB and 512GB configurations have a 9-core CPU,...

iOS 26.4 is expected to introduce a revamped version of Siri powered by Apple Intelligence, but not everyone is satisfied with how well it works.

In his Power On newsletter today, Bloomberg's Mark Gurman said some of Apple's software engineers have "concerns" about the overhauled Siri's performance. However, he did not provide any specific details about the shortcomings.

iOS 26.4 will...

Apple on Wednesday updated the 14-inch MacBook Pro, iPad Pro, and Vision Pro with its next-generation M5 chip, but previous rumors have indicated that the company still plans to announce at least a few additional products before the end of the year.

The following Apple products have at one point been rumored to be updated in 2025, although it is unclear if the timeframe for any of them has...

Apple plans to launch MacBook Air models equipped with the new M5 chip in spring 2026, according to Bloomberg's Mark Gurman. Apple is also working on M5 Pro and M5 Max MacBook Pro models that will come early in the year.

Neither the MacBook Pro models nor the MacBook Air models are expected to get design changes, with Apple focusing on simple chip upgrades. In the case of the MacBook Pro, a m...

With the fourth beta of iOS 26.1, Apple added a toggle that makes Liquid Glass more opaque and reduces transparency. We tested the beta to see where the toggle works and what it looks like.

Subscribe to the MacRumors YouTube channel for more videos.

If you have the latest iOS 26.1 beta, you can go to Settings > Display and Brightness to get to the new option. Tap on Liquid Glass, then...