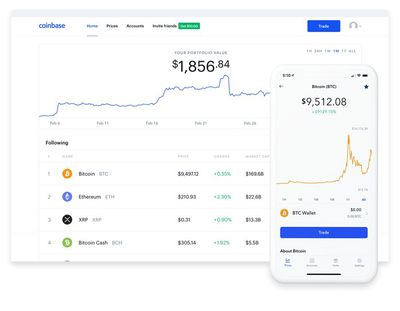

Popular cryptocurrency exchange Coinbase has announced that it is now allowing traders to use bank cards linked to Apple Pay to purchase crypto assets on the platform.

"Today, we're introducing new and seamless ways to enable crypto buys with linked debit cards to Apple Pay and Google Pay, and instant cashouts up to $100,000 per transaction available 24/7," said a Coinbase blog post on Thursday.

"If you already have a Visa or Mastercard debit card linked in your Apple Wallet, Apple Pay will automatically appear as a payment method when you're buying crypto with Coinbase on an Apple Pay-supported iOS device or Safari web browser."

In addition, Coinbase said it is also making it easier and faster for users to access their money by offering instant washouts via Real Time Payments (RTP), allowing customers in the U.S. with linked bank accounts to instantly and securely cash out up to $100,000 per transaction.

In June, Coinbase debit cards gained Apple Pay support, allowing it to be added to the Wallet app on iPhone. The Coinbase Card automatically converts the cryptocurrency that a user wishes to spend to U.S. dollars, and transfers the funds to their Coinbase Card for Apple Pay purchases and ATM withdrawals.

Top Rated Comments

Everything in crypto is just a ponzi scheme (and a bit like a pyramid scheme). You own a crytocurrency? You hype it up blindly in order to get more buyers. Then you exit for a profit. Anyone saying cryptocurrency is useful or is the future is only saying that to drive hype, thus price, before exiting.

14 years later, crypto hasn't done anything useful except enabling money laundering and buying illegal things. Not only that, it wastes energy (green or not) and hundreds of thousands of people talent that could have gone into solving more pressing problems in the world.

What cryptocurrencies are is just a modern, efficient way of creating and exiting scams. Cryptocurrencies take advantage of social media to spread and the fact that there is a lot of cash looking for "investments" due to our current low interest-rate environment.

Unlike owning things like stocks where the entities must have boards, report financials, have audits, disclose risks, crypto companies can raise $100 million and then completely shut down the next day without any repercussions except getting a few angry tweets from investors. Once you give money to a crypto project, the founders can do whatever the hell they want.

People say blockchain doesn't have a "killer application" yet. Actually, it does. Its killer application is scamming.

There is a reason why a significant portion of crypto companies are registered in the Cayman Islands.

I wish the U.S. and EU would just grow a pair and ban all crypto like China did.

For a blockchain, you can only pick 2 of the 3 following: decentralization, security, and performance.

Bitcoin is very decentralized (copies of the blockchain in millions of computers) and has good security (mining). But it can only perform 4.6 transactions per second because mining is incredibly computationally intensive and the blockchain is spread across millions of computers.

Compare this to Visa. Visa prioritizes security and performance. It's centralized. For simplicity of explaining this, Visa transactions only need be verified by Visa, probably using a high-performance centralized Oracle database. This allows Visa to handle 24,000 transactions per second and this limit can easily increase with more CPUs and servers.

All cryptocurrencies just turn the dial between decentralization, security, and performance. Any magical new blockchain that promises "100000x" the performance of Bitcoin is just less decentralized with less security. These blockchains are usually easily manipulated. In fact, there's a website dedicated to calculating how much it costs to attack them: https://www.crypto51.app/

Any cyrptocurrency that wants to process as many transactions as Visa will basically have to use a system very similar to Visa's which means it's no different than Visa. And we already have a Visa (and many other legitimate financial companies).

Hence, Bitcoin is just "digital gold" or something that does nothing except sit there and drain up a country's worth of energy.

There are very complex financial systems growing around the trading & exchanging of Cryptos, especially over the past 2 years. If a crypto coins future potential-use was as clear as day then absolutely everyone would be jumping onboard overnight, destabilising the market.

However there is slowly but surely heavy investment being poured into setting up infrastructure and governance systems that are facilitating crypto’s growth and I can’t see that it’s all being done simply to profit from some hype bubble.

I don’t think anyone knows with absolute certainty what the use-case will be for all these intangible digital coins all with their own tokenomics at play, however enough people believe that there will be a radical shift to their use over fiat and other commodities in the trading of value in the future.

I think you’re judging it too harshly too early, in the scope of a millennium of technologically advanced civilisation, a decade is nothing really. There is a future somehow for these digital coins.

This is the third person who refuses to address any of my points except to resort to ad hominem.

Quote my arguments and provide your counterargument. Let's debate.

Before, gold was the backer for cash, but ultimately it has no intrinsic value these days. The banks just print more when needed. It's backed by no asset so just like crypto, it can fluctuate and the price can be manipulated easily.

And you trust your government with your money?

Take Cyprus as an example. (All bank deposits over €100k were seized no matter how legit your money was).

Take Spain as an example. (The tax office can seize money without warning at their discretion)

Governments can manipulate currency to their hearts' content.

The point of decentralization is to protect against this. That's why it carries value.