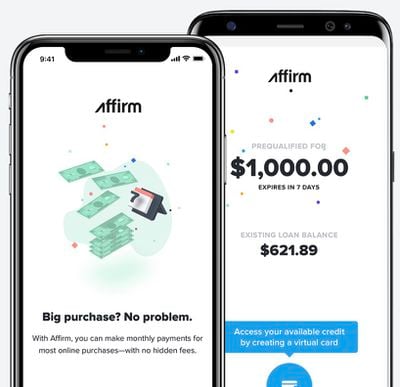

Affirm is a financial startup that allows users to pay for expensive items from select retailers in monthly installment plans, after they are first approved for a loan on the company's website or in the app. Today the company announced that users will now be able to secure credit in seconds and then checkout in retail stores thanks to integration of the Affirm virtual card into Apple Pay.

To apply for Affirm financing, customers complete a "simple, five-field" application that provides them with a real-time credit decision (rates are between 10-30 percent APR based on personal credit). After approval, customers use the Affirm app to enter the amount they want to spend by selecting a payment plan on the item (3, 6, 12, 18, or 24 months), and Affirm loads up the cost of the full purchase onto the virtual card, paying the merchant for the item and taking on "all fraud risk for the purchase."

With the addition of Apple Pay, Affirm's virtual card can be used anywhere that Apple Pay is accepted.

“People’s shopping habits are evolving very quickly, beyond simply moving online-to-offline or offline-to-online when engaging with merchants,” said Rob Pfeifer, Chief Retail Officer at Affirm. “Consumers are on their phones, online, and in-store throughout a shopping experience. Affirm provides a solution for this omnichannel experience in the form of transparent and honest finance.”

For merchants, Affirm says it provides two options to support the service: integration with the Affirm InStore API with their own point-of-sale system, or support Affirm's expanded virtual card experience. The company explained that regardless of what method merchants choose, the customer's retail checkout process is "virtually identical" to Affirm online and in the iOS app.

Affirm founder and CEO Max Levchin told Bloomberg that the company hopes it will continue to expand and that more stores will "embrace" Affirm because of its ability to offer retailers "insights into customer purchasing habits."

Levchin hopes more stores will embrace Affirm’s approach by offering them insights into customer purchasing habits. With Affirm In-Store, retailers are able to track if someone applies for a loan in the shop but finishes the transaction elsewhere. This is designed to let the retailer better understand the impact of sales staff.

“I’m optimistic there will be a day when shoppers instinctively reach for their phone and the Affirm app, rather than their credit card,’’ Levchin said.

In its press release, Affirm detailed how Apple reseller Simply Mac switched from paper-based applications for loans on its private label credit card, to Affirm InStore's new process. Tiffany Polmateer, Simply Mac’s director of purchasing and operations, said that since supporting Affirm it has seen a 20 percent increase in average order values, 63 percent more customer financing applications, and 34 percent more approvals per store.

Affirm is available to download on the iOS App Store for free. [Direct Link]